In recent years, well-known brands like Qumei, Baiqiang, and Yifeng—originally prominent in the panel furniture sector—have started to make their mark in the solid wood furniture market. These new solid wood products are often displayed prominently at store entrances, drawing immediate attention from customers.

Wen Shiquan, chairman of Yifeng Furniture, once remarked that while panel furniture is seen as a future trend, solid wood furniture offers greater flexibility and value. It allows for more elegant, stylish, and personalized designs, which has helped it maintain a significant market presence despite competition.

Currently, panel furniture still holds about half of the market share, while solid wood furniture accounts for roughly two-fifths. The rest includes upholstered and other types of furniture. Over the past five years, solid wood furniture has shown consistent growth, with panel furniture's market share gradually declining.

According to Shen Yaojun, vice president of Beijing Jimei Home Furnishing Market Group, the solid wood furniture market is growing at an average annual rate of 5% to 8%. Although panel furniture still leads in sales due to its lower price point, its market share is expected to shrink over the next few years. This shift is driven by changing consumer preferences and a growing emphasis on environmental protection.

"In the West, panel furniture is becoming more popular," Shen noted. "This is because foreign manufacturing technology is more advanced, allowing for significantly reduced harmful substances in panel furniture. Additionally, consumers there have a strong environmental consciousness, which encourages the use of less natural wood."

In China, however, several panel furniture brands have faced scandals related to excessive formaldehyde levels, leading to public concern. As a result, many consumers are now prioritizing health and safety, opting for solid wood furniture when possible.

Environmental concerns have also led to a decline in panel furniture’s popularity. Liu Yang, deputy general manager of Chengwaicheng Furniture Plaza, observed that the panel furniture industry once had a low entry barrier, resulting in many small, unregulated manufacturers. However, in recent years, only those with strong reputations and eco-friendly practices have survived, while smaller, less reputable brands have exited the market.

As environmental awareness grows, more consumers are paying closer attention to the quality and sustainability of their furniture. Panel furniture that doesn’t meet environmental standards or lacks proper edge sealing is losing favor. Meanwhile, solid wood furniture, known for its low formaldehyde content and rising affordability, is gaining a broader customer base.

Some panel furniture companies have even begun transitioning to solid wood, with brands like Top 100 and Yifeng seeing positive market responses.

"Solid wood furniture has become much more refined," Liu said. "It used to be dominated by domestic wood and was seen as bulky and outdated. Now, many imported woods are used, offering a better quality feel. In terms of design, modern elements have been incorporated, making it more appealing to younger generations."

Looking ahead, how should panel furniture manufacturers respond? Shen Yaojun believes they should take a long-term view, expand production scale, reduce costs, and increase market share. He noted that only those with large-scale production and competitive pricing have survived the industry shake-up.

Yu Xiusu, secretary-general of the Beijing Furniture Industry Association, emphasized the need for panel furniture manufacturers to strictly control raw materials and production processes. Using environmentally friendly panels and improving edge-sealing techniques can help reduce formaldehyde emissions, ensuring product safety.

Additionally, Shen suggested that manufacturers explore new distribution models. While some factories have tried to open their own branches nationwide, this approach hasn't always worked well. Instead, he proposed a joint-stock cooperation model, where distributors and manufacturers share profits. This could motivate distributors to adjust strategies, boost sales, and create a win-win situation.

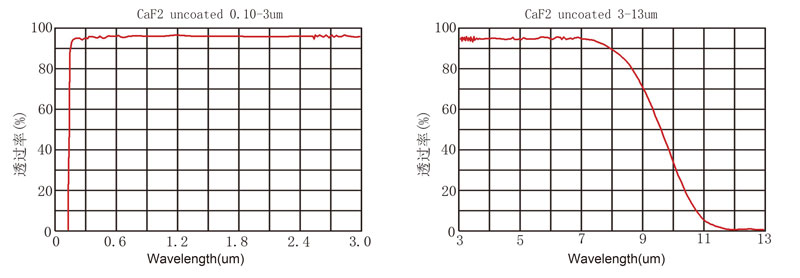

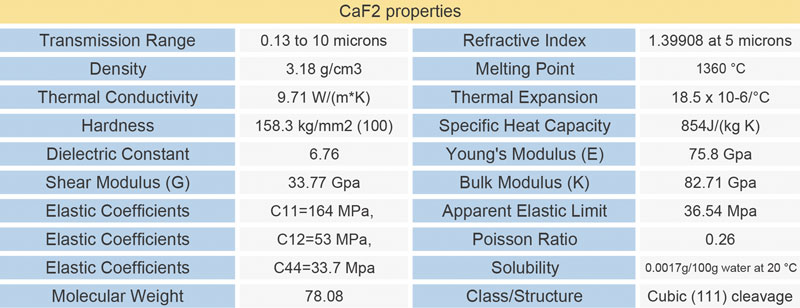

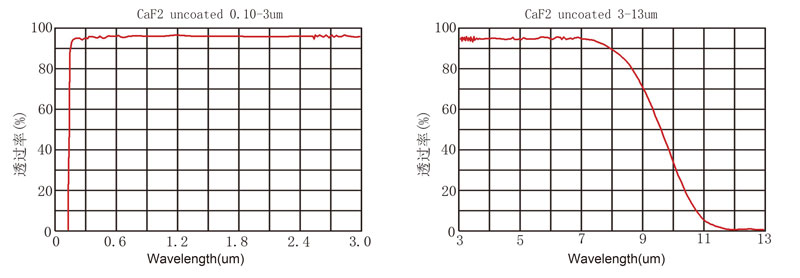

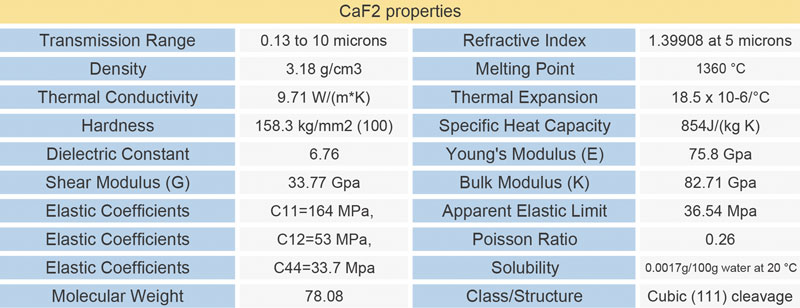

Calcium Fluoride Lens

Calcium Fluoride Plano-Convex Lenses are ideal for demanding applications that require superior performance from the ultraviolet through the mid-wave infrared spectra.Calcium Fluoride PCX Lenses` low refractive index, high laser damage threshold, and low axial and radial-stress birefringence are highly suitable for use with Excimer lasers or for integration into infrared systems. Additionally, calcium fluoride features low solubility and offers superior hardness to comparable fluoride-based substrates, making these PCX lenses capable of withstanding harsh environments and exposure to the elements.

We offers high precision and quality caf2 Lens and windows with cost-benefit price as well as stable supply ability. Dimensions and shape depends on your project. Meanwhile, experienced engineer could advise you professional advices according to your applications, drawing is aslo available.

Â

Â

Â

| CaF2 lens and windows specifications: |

|

|

| Â |

Standard precision |

High-precision |

| Dimension Tolerance |

φ5-150mm+0/-0.2 |

φ3-200mm+0/-0.2 |

| Thickness Tolerance |

1-50mm+/-0.1 |

1-50mm+/-0.05 |

| Parallelism |

1 arc minutes |

10 arc seconds |

| Surface Quality |

60/40 |

20/10 |

| Flatness |

N<λ/2@633nm(at 50mm) |

N<λ/10@633nm(at 50mm) |

| Clear Aperture |

>90% |

>95% |

| Chamfer |

Protected <0.5mmx45deg |

Protected <0.5mmx45deg |

Â

Calcium Fluoride Lens,Calcium Fluoride Cylindric Lens,Calcium Fluoride Pcx Cylinder Lens,Calcium Fluoride Aspheric Lens

China Star Optics Technology Co.,Ltd. , https://www.csoptlens.com